Summer 2024 Introduction

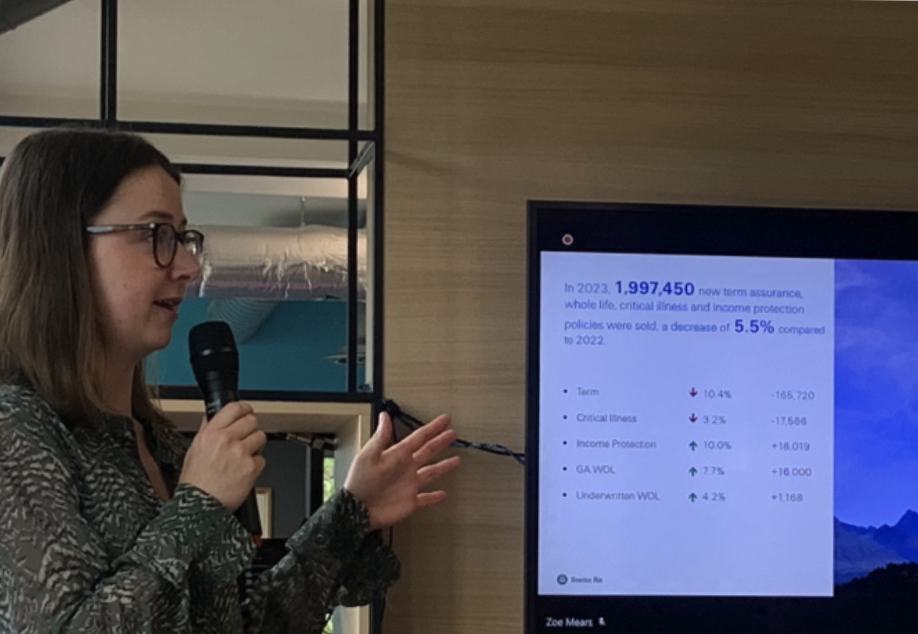

In May, Swiss Re launched Term & Health Watch 2024, a report iPipeline have supported with our data for the last 5 years.

We were delighted to welcome Joanna Scott, Technical and Industry Affairs Manager at Swiss Re and one of the lead authors of the Term & Health Watch, to our office recently to hear a high-level summary of the report. The stats were fascinating, some unsurprising, some rather more alarming.

Term & Health Watch looks at individual protection market statistics including term, CI, IP and WOL. It is a combination of data from providers across the market at the end of the year, plus iPipeline insights throughout the year which provide more granularity.

So, what did we learn? Total new term sales have declined by 10.4% in 2023 with the cost-of-living crisis – the lowest reported by Swiss Re since 2016, while new income protection policies have increased by 10% but I won’t steal Joanna’s thunder – you can read more on this in her article on page 4.

It’s clear that during 2023, consumers still had a tough time when it came to household spending. The Bank of England raised interest rates 14 times and still hasn’t brought it down. In the Financial Conduct Authority (FCA) Financial Lives cost of living survey issued in April, it is worrying to read that people were still not taking out insurance, or had cancelled or reduced their level of cover which explains some of the trends in the protection market.

We recently conducted a survey to understand adviser sentiment, the findings of which can be seen here. My overall takeaway over these last few weeks is that reports such as those from Swiss Re and the FCA are invaluable in understanding our market and making data accessible.

Likewise, I can also see we are reversing this downward trend in 2024.”

Written by:

Term & Health Watch 2023

On 21 May, Swiss Re published Term & Health Watch 2024. This is an annual analysis of new individual protection sales in the UK from the previous year, based on sales data provided by protection insurers. iPipeline has been a key contributor to the data for several years, adding insights gained from its platforms.

I appreciate it may seem odd to be writing about 2023 when we are already almost halfway through 2024. However, the publication of Term & Health Watch each year is a helpful time to pause and reflect on the trends we saw last year and what is continuing into 2024 or beginning to emerge.

Looking back, 2023 was another challenging year for total sales in the protection market. However, this was not felt equally across the product lines. We saw a total market decrease of 5.5% but this was led by a drop in term assurance and critical illness sales, which fell by 10.4% and 3.2% respectively. This was largely due to a slowing housing market and a sharp decline in non-advised sales (we saw a 27.7% drop in non-advised level term assurance sales).

It is not all doom and gloom though. We saw a rise in income protection sales (by 10%), guaranteed acceptance whole life (by 7.7%) and underwritten whole life (by 4.2%).

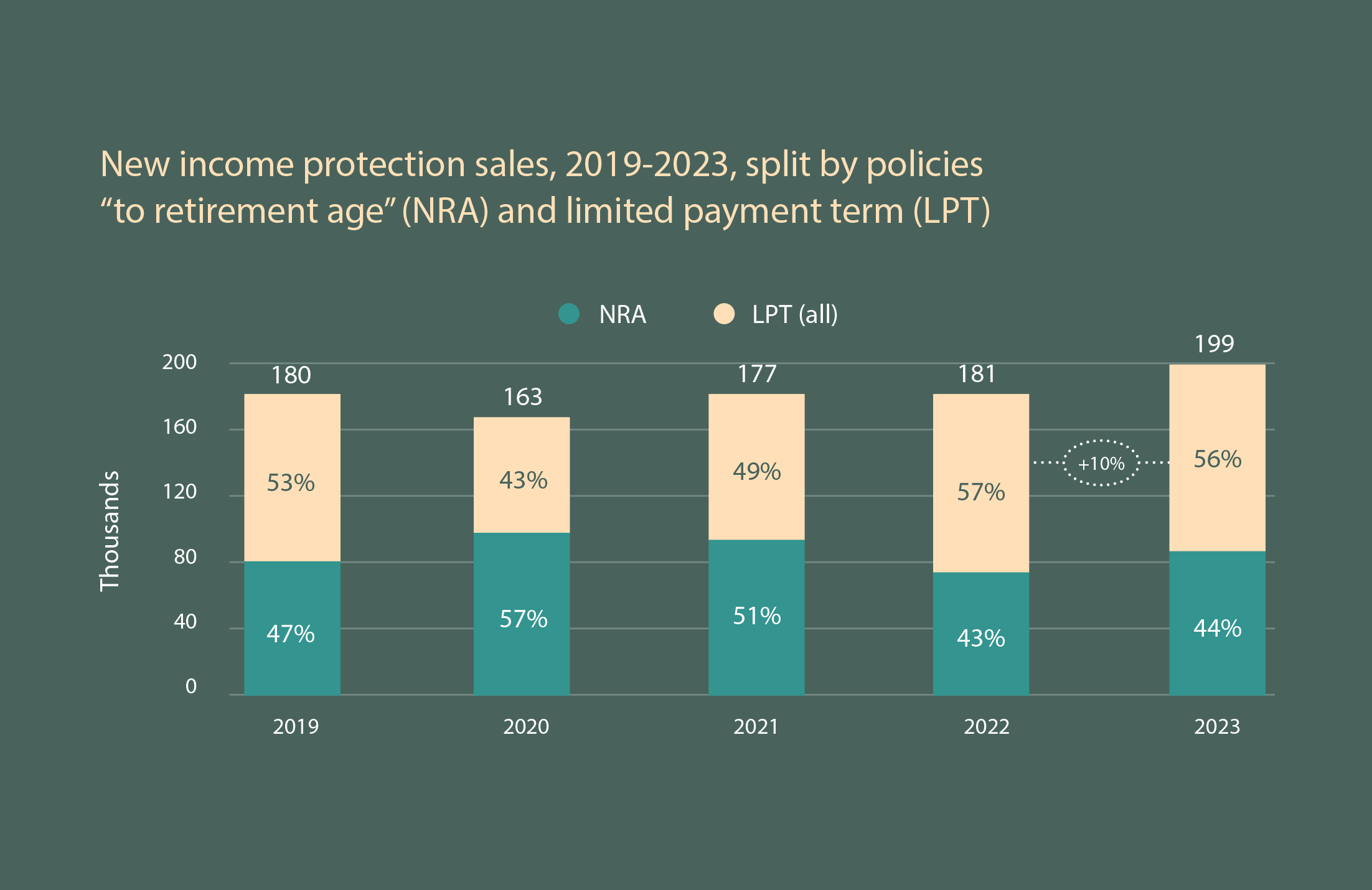

It is great to see that income protection sales continue to grow at a good pace. We were pleased to see that this growth was driven by an increase in sales in both the “to retirement age” and the two-year limited payment term products, where in previous years the growth has been led by the latter.

Limited payment term products represented 56% of all new sales, a small shift from 57% in 2022. The two-year product is the most popular, representing 96,817 of total sales, an increase of 12.2% from 2022. This has fluctuated over the last few years as you’ll see in the chart below.

It is positive to see that customers are buying income protection products, regardless of payment term, as this will provide some form of safety net if the worst were to happen. This is especially the case for those who receive no workplace cover above of Statutory Sick Pay (SSP) or are self-employed and would have no access to SSP.

While we are not out of hot water fully yet as we still experience elevated interest rates and an upcoming General Election which can bring a degree of uncertainty with it. The industry should keep up the momentum for income protection and focus on the green shoots taking root in the market.

Written by:

In Conversation With: Paul Yates & Ron Wheatcroft

Protection Market 2023 – State of the Nation

During May, as the release of Swiss Re Term & Health Watch for 2024 approached, two of the most experienced heads in the industry sat down to debate the big issues in protection highlighted by the report. If you know Paul and Ron, you won’t be surprised to know that the discussion was long (and fruitful) with far too much to squeeze into this edition alone, so there will be more to follow as we go through the year.

The first debate surrounded the nature of demand in the protection market, where and how it is impacted by adjacent sectors and wider economic themes and what the data for 2023 is showing.

Paul, tell us your thoughts on the importance of data

We rely heavily on data to understand current market trends, our past performance, and future directions. Numbers are essential for identifying necessary actions and improvements.

So how was 2023? A bit of a mixed bag in summary. Term only sales declined by around 11-12%, whilst Income Protection (IP) was up by 10%. Also up was Whole of

Life (WoL) and Business Protection. Total (advised) sales year on year were slightly higher than 2022. I think the summary from the iPipeline commentary in Term & Health Watch nicely summed up the market in 2023 – same same, but different. The biggest drop (again) was the non- advised market and that’s primarily level-term because it’s the simplest product for customers to understand and therefore most demanded in non-advised sales.

So, it is clear that advisers fared well in a heavily-depressed mortgage market, which begs the question, do advisers treat protection as a bolt-on?

Ron, you have a long history with the data of Term & Health Watch. How do the numbers compare to those of the early ‘00s?

The numbers in Term & Health Watch some 15-20 years ago told a similar tale in that the overall results were impacted by mortgage-related activity. The once-upon- a-time reports that 50% of new protection sales in a year were mortgage related has reduced to more like 30-35%.

We’re becoming more of a nation of renters. So, what are we going to do to support the shift from borrowers to renters and what do we have to protect them? Is this a conversation we’re missing and need to be having?

Absolutely – these conversations are being missed. So how and when are we now offering advice Paul?

As more people obtain mortgages later in life and opt for longer mortgage terms, protection insurance becomes pricier. This trend, combined with the increasing popularity of long fixed-term mortgages, limits opportunities to discuss and update protection plans.

Since mortgage events alone are no longer sufficient triggers for discussing protection, we need to establish a dedicated “protection event.” Any personal or social change, or changes to a mortgage, should be viewed as an opportunity to review protection needs. This approach shifts away from past practices of at home visits.

Since the ‘man from the Pru’ doesn’t come knocking on people’s front door anymore with his protection first approach, we’ve lost our ability to provide broader financial advice more routinely to the masses.

Agree. Reviews are important – what is the missing link Ron?

This all then points and challenges the products available in the market – if they were flexible enough, you might not need to change or move to a new policy. But a regular review is important, and we need to get inside the minds of our customers. It’s as simple as they have a series of financial and personal needs which they really want to address, so we must maintain dialogue. The Consumer Duty should strengthen the case for regular dialogue and, more generally, a flight to quality.

How do we do this? It starts by creating more awareness.

How are protection needs changing in later life?

Paul, questions around longevity and pensions are topical. So, what are the risks?

Is writing protection to 65 or still appropriate these days? Considering someone getting a mortgage at 35 with 30-year terms, their coverage will expire at 65, just when they might still need income to manage debts or living expenses due to illness or death. With more people carrying debt into retirement and potentially working longer, we possibly need to rethink the appropriateness of current protection terms, or flexibility of products.

There are many concerns around affordability – Ron, what are the options?

People aren’t saving enough and they’re not protecting themselves enough either. People are concerned about the NHS and wanting an emergency cash fund that will meet their needs. PMI might be too expensive so many are looking at CI. It might not be the perfect solution, but it does provide greater financial stability. So, the need for a product is driven by external factors. A number of employers are now offering voluntary or flex critical illness schemes. This is where we’re seeing growth, with consistent year-on-year growth and more than 900,000 people now covered.

While it is a lot about cost, there are other factors, Paul?

We have a cost versus convenience model for demand generation. Even if prices haven’t dropped, ease of access and direct communication from advisers often convince people to take out policies. It’s a self-reinforcing cycle.

There has been a notable increase in income protection (IP) policies in 2023, reported by entities like Swiss Re, iPipeline, and the ABI. The surge in interest could still be influenced by COVID-19, heightening consumer awareness and anxiety about financial security.

The Income Protection Task Force (IPTF) has been actively promoting IP through initiatives like IP Awareness Week (IPAW), and iPipeline has contributed significantly with extensive training. This support has boosted advisers’ confidence in recommending IP. Additionally, data show that IP policies sold by mortgage brokers have grown significantly, with an 18% increase in Annual Premium Equivalent noted in 2023, underlining the value of the data we provide in the Term & Health Watch Report.

Ron, tell us about these increases?

We’ve seen increases across both the individual business side and the employee benefits side too where there was a net increase of 201,377 people who are members of insured workplace schemes at the end of 2023.

All the increases tell positive stories, especially for our discussions with the next government. The insurance sector has a big role to play in supporting employers and their workers and making inroads into the number of long-term sick.

Positive news, Paul, yet still an underserved market to address?

Agreed. This once hard to write and expensive product has changed and we’re now seeing significant improvements. The conundrum remains though around renters and younger people – who is selling or is going to sell IP to them?

Ron, you’re tackling the challenge of protection for renters?

It’s one of our biggest challenges to get IP for renters on the same footing as mortgages. Sadly, the Renter (Reforms) Bill, which would have achieved this had amendments proposed by the Building Resilient Households Group been accepted, did not survive the pre-Election sweep up so this will be one to return to. With a mortgage we’ve got a mortgage adviser, while renters are missing that advice point so does this open an opportunity for signposting?

Finally Paul, the need is there, it’s just about finding a way

The answer has to be in the product and people – getting the right people and technology in front of renters rather than expecting a rental agent to go in and sell IP.

Join us next time for more discussion and debate on market consolidation, falling premiums and more!

Written by:

Understanding motivation: flipping the protection conversation

How well do we understand the value of critical-illness protection to customers?

When we consider that only 19% of people are using critical-illness-claim payments to pay off all or part of their mortgages, should we be updating the way we position protection products to customers and focusing on a variety of possibilities? Are large expenses such as mortgages what resonate most?

Legal & General’s ‘Deadline to Breadline’ research in 2022 gave us some useful insights. It showed that, when experiencing financial difficulties, clients would be less willing to cut back on their broadband compared to their heating and lighting, and more likely to cut back on food than mobile-phone expenses. So do we need to be talking to clients in ways that connect to these real-world motivations?

For years, sales and marketing departments have positioned the cost of protection as a substitute for something that’s already being paid for. They might say, “for the cost of a cup of coffee a week,” or, “for the price of your Netflix or Sky Sports subscription” you could have the following sum assured. How does this approach damage the way we promote protection?

Flipping the conversation

Rather than asking clients to mentally exchange something they enjoy, what if we asked them how they could keep the lifestyle they love, whatever happens? When we ask a ‘how’ question like this, the mind automatically looks for a solution.

“Why should I do this?” becomes “how can I make this happen?” “Why must I give up my subscription?” becomes “how can I afford this?”

Instead of competing with what’s important to people, we can use their motivations to frame the conversation that follows: Critical Illness Cover is a product that allows you and your family to stay in the home you’ve worked so hard for, and continue to live the lifestyle that you enjoy. It’s not something to begrudgingly put in front of life’s treats.

Benefits from Day One

Framing protection as a positive purchase also makes it easy to talk about the added value clients and their families can get from their policies. Gone are the days when plans would be put away in the desk drawer and left to gather dust until a claim. Legal & General’s policies give access to Wellbeing Support (for telephone advice from a nurse) and our Care Concierge (for help with later-life care) from day one for the client and their immediate family, so they can immediately see tangible value. Flipping the conversation to focus on the day-one positives of cover is another useful way to focus on real-world motivations.

Want to learn more? Watch this and other webinars on this topic

Written by:

Making protection excellent (again)

As we enter what could be an interesting summer across global politics, I couldn’t resist taking a crowbar to this infamous recent campaign tagline and applying it to our own market. Let’s make protection excellent again!

Is protection not already excellent I hear you say?! If I was to write the protection market’s school report, it would say, failed to achieve full potential (and somewhat disruptive in class). Many would argue that we have made great strides, but the number of those covered in the UK and the sheer number of consumers left without any protection would indicate otherwise. There is something amiss.

In my previous two pieces I explored some of the reasons why, and clearly – I’m a (subliminal) fan of alliteration.

For as long as I’ve been in the industry (10 years this October!), we have struggled with low levels of engagement – mainly from consumers who don’t understand the need for cover and even when they do, lack the urgency to act. But also from advisers, some of whom deprioritised protection, citing growing regulatory pressure, challenging mortgage and financial markets. Those that are writing have faced challenges in the speed of delivery and commercial pressures. This lethal combination has left us constrained and unable to break into new markets that we desperately need, in order to reach the consumers of today and tomorrow.

The protection market has long been searching for the efficiency which delivers greater margins and more importantly, meets the expectations of today’s customer.

The impact of these constraints alongside others, such as increasing product complexity, is a market which has failed to meet the level of excellence required to grow substantially. Whilst all financial services sectors have faced huge challenges in recent years, many a result of tech and digital disruption, we have failed to adapt and evolve as successfully as some.

Take banking, for example. The disruptors, the Revolut’s and Monzo’s of the world have not only taken market share from the big banks, but they have also shown that a better way is possible. They have strived to deliver a better experience, to deliver excellence. They have lifted the sector for the better.

So, where’s the disruption coming from in life and protection? How can we reach the excellence required to take the market to the next level?

Making the complex simple

Protection breeds and cultivates complexity. Whether it’s product, definition or service, the market tends to find a way to foster complexity. There are reasons why this is the case, writing long term insurance isn’t easy, commercial models are entrenched, but we have accepted it as inevitable for too long. Now is the time to embrace simplicity in product design. Yes, customer budgets are perhaps smaller than they were a couple of years ago, but their attention spans are even smaller. In modern markets, simple wins.

Experience over product

Providers LOVE a new product, new feature or new enhancement. That’s to be applauded, there is no lack of effort or passion invested into what we do. However, there are unintended outcomes of this product-based arms race.

Insurance by definition is always going to contain complexity. Definitions and terms and conditions need to be unambiguous. But at times product development is at best misdirected, at worst irrelevant. When there are still dysfunctional elements of service, like a disjointed and often opaque application process, to continue to invest so much time and effort into products could be described as misguided.

Would time be better invested in the most important ‘product’ we can all develop? That product being the service experience offered to customers and advisers. Everything encompassing purchasing, managing and using a policy? I think so.

Consumer first

Are we as obsessive about our customers as we should be? There still seems to be a large disconnect between what consumers want and what the market delivers – my arguments about complexity and experience above being just two key examples.

But there are more areas which highlight a disconnect between consumer perception and demand and protection reality. Take premiums for example. iPipeline data shows that protection premiums in the UK continue to fall, pushed by competition. Compare this to expectation, most consumers expect protection to be more expensive than the reality.

Does that paint the picture of a sector totally in touch with consumer demand? No. Does it highlight an obsession with competition. Yes.

There needs to be accountability from us all if we’re going to make protection excellent again. We need to be obsessed about our end customers, but equally we need to be obsessed with the full value chain, from product design, reinsurance, portals, intermediaries, and execution channels. We have to listen to understand, not listen to respond with a slightly more competitive offering. If we don’t do it, the regulator will. I for one am passionate about helping move our industry into a growth market and jointly if our industry remains engaged, we can achieve this.

Written by:

Why we need to learn a new superpower. To engage.

The biggest and best brands in the world have superpowers, the things they do better than anyone else.

And they’re usually not shy in letting you know what they think theirs are, either overtly or in a slightly more subtle way. Take Patagonia for example. They have become one of the most successful modern outdoor clothing brands almost purely because of their single superpower, which is in their case purpose. They are run ethically and put the environment above all else, stating one of their core values as, ‘Protect our home planet’. I’m not quite sure how jumpers can do this, but it certainly resonates with customers.

There are other examples of brands that have built their success on a single superpower. Audi has focused their reputation and success more on the excellence of their engineering than the comfort or style they offer their buyers. Talking to my friends who are mechanics I would maybe question whether this mirrors the reality, but there you go.

So, what do automative and clothing brands and their superpowers have to do with protection I hear you ask? Time for the tenuous link.

The answer is nothing. Well, nothing in isolation at least. It is more the principle of superpowers I’m interested in.

If we were to ask the question of any protection brand, or indeed the market as a whole, what is our superpower, I’m not sure you would get a consistent or compelling answer. It might be the best risk management, given that the UK has some of the lowest protection premiums in the world, but I think you’d struggle to sell that idea beyond a certain audience!

Equally, the protection market is one which continues to be defined as niche rather than mass market. One serving a smaller proportion of the public than it would like, leaving more people with unsecured financial futures. There are many reasons why this may be the case. You could argue that any form of insurance is a reluctant purchase. Protection has been accused of being complex and the buying process can be slow, plus public perception that claims are not fulfilled are all valid reasons for market struggles.

However, no matter how much we think about it and tackle these issues which undoubtedly impact the market, it will mean little if we don’t find a way to better engage consumers. This demand generation is key to the success of any market in the long term. A great business, a great product or a great service without customers is just a thing. It is interest and demand which makes the difference.

So, here’s my rallying cry. The protection market needs to make engagement one of its superpowers. We need to develop and cultivate a laser like focus on engaging the UK public in what we do, enabling them to build the financial resilience they so need.

How we go about doing this is the million-dollar question. The answer, sadly, is more complicated. We have watched and observed several attempts at pan-industry awareness campaigns come and go, with little to no agreement. We have seen more success in campaigns such as 7Families, having an impact but not a seismic one.

For now, in my opinion the focus should be on advisers and enabling them to enhance their customer engagement tactics. This is, if you like, our great field sales force. Representatives of brand protection, fighting for the time and attention amongst pensions and wealth planning, trying to get attention through the process of buying and borrowing for dream homes.

Advisers have long been advocates for protection, but the market hasn’t made it easy for them. Consumers understand little about what protection is and does and they don’t understand the choices that they need to make to even acquire a premium and see first-hand just how cheap it can be.

Technology can help and it doesn’t have to cost the earth either. Advisers don’t need to immediately invest thousands in lead generation campaigns to stimulate the next generation of protection customers. We’ve just launched a new, improved version of our ground-breaking PreQuo Lead Gen tool – designed to maximise and convert web traffic into qualified protection leads.

By avoiding asking consumers questions they simply can’t answer, PreQuo Lead Gen keeps them engaged in the protection journey, educating them on their requirements.

We have seen in the recent FCA Financial Lives survey that consumers are still cancelling cover, with cancellation rates across all insurance products currently running at 20%. I would imagine those were when the consumer was not engaged or felt invested in the decision process.

If clients don’t understand why they bought the policy, if they don’t know what the benefits are, then they certainly don’t understand the impact of cancelling. PreQuo Lead Gen can help cut through that.

Written by:

Engagement Excellence: Are we looking down the wrong end of the telescope?

There is no doubt that we live in a fast-paced industry with never ending changes, fluctuating interest rates, regulation, Consumer Duty, technology changes and the threat from larger, digital options for clients. For advisers, it can be overwhelming.

With all this change comes a fear of what the future might hold. What does it look like for advisers? What skills will they need? What channels will they use? How will they interact with their clients?

While many embrace the benefits of new technology, this doesn’t change the fact that people like dealing with people. They appreciate the human touch and hearing expert insights. This suggests advisers will always be needed but perhaps how we offer advice will change.

Despite emphasis on other elements, the one area I feel is regularly overlooked, which more often than not is the secret sauce to success, is engagement. Yes, engagement!

Just last quarter the news broke that Amazon was pulling out of the insurance space. Was it any surprise? While a shame for the employees, it proves the complexities of the industry we work in. One of the largest organisations in the world, with their customer centric obsession, has admitted defeat, despite the wealth of resources at their disposal.

This is an industry that requires engagement. That doesn’t mean exchanging pleasantries over a cup of tea; it is about reaching people when they are interested in what you have to offer and in a way that makes them feel comfortable and confident enough to buy.

A profound shift is underway. Moving beyond the traditional transactional approach of selling policies, forward-thinking firms are reimagining client engagement as a journey of protection, education, and empowerment. However, as we navigate this transformative era, a critical question looms: Are we looking far enough into the future to meet the changing needs of clients, particularly the younger generations?

Recently I read an interesting research study from the Boston Consulting Group study on Building Customer Experience for the Future which states:

If you’re working on an omnichannel strategy, you’re already two steps behind. The most successful companies aren’t just meeting customers where they are today; they’re looking for ways to engage them tomorrow.

Gone are the days when simply closing a deal marked the end of the interaction with a client. Today’s savvy consumers expect more. They demand an ongoing relationship built on trust, transparency and value. It’s not just about selling a policy; it’s about guiding clients through their financial journey, identifying their unique needs and addressing any gaps in cover as their lives evolve. By providing a multi touch approach throughout the lifetime of the client, we can ensure a client for life and also capture new opportunities for the future.

Education plays a key component here. Empowering clients with knowledge about various protection options, risks and the importance of comprehensive cover is essential. By fostering an understanding of protection products, clients are better equipped to make informed decisions aligned with their financial goals and circumstances.

Crucially, this educational initiative extends beyond the initial sale. Continuous engagement involves periodic reviews to reassess clients’ evolving needs and identify gaps in their cover. Whether it’s changes in personal circumstances, offering tailored solutions that evolve alongside their circumstances, or emerging risks, proactive monitoring ensures clients remain adequately protected at all times.

A cornerstone of this emerging approach is technology. Companies who are investing in technology to empower clients with knowledge and educate regularly using platforms that meet clients where they are, at relevant stages of their journey will move forward into the future and foster a deeper understanding of their customer’s needs. For example leveraging advanced analytics and data insights through innovative technology solutions, adviser firms can assess clients’ overall risk exposure across multiple policies. Clients can use mobile technology to access their full risk score at any time and receive relevant, regular communication from advisers about their risk. This holistic approach enables advisers to offer targeted recommendations to mitigate potential vulnerabilities and optimise coverage while fulfilling many of the requirements of Consumer Duty and strengthen trust in the advisory relationship.

Yet, perhaps the most vital element of this evolving paradigm is nurturing clients. It’s about fostering meaningful connections, providing ongoing support, and demonstrating genuine care for clients’ well-being. This requires a shift from a purely transactional mindset to one focused on building long-term, mutually beneficial relationships. Using modern technology like BrokerIQ can play a huge role in using client specific data to automate important communication at the relevant time to clients, providing an ongoing duty of care and information that nurtures the client relationship and brings clients on a journey of protection.

As we contemplate the future of client engagement, we must not overlook the importance of reaching younger generations in protection planning. Millennials and Gen Z represent the future of the financial services industry, and their expectations differ significantly from previous generations. Recognising the importance of early intervention, industry stakeholders who are forward thinking are devising strategies to engage millennials and Gen Z in the way that suits them. They demand personalised, tech-savvy experiences, and they expect firms to meet them where they are, whether that’s through social media, digital platforms, or innovative communication channels. Not all clients will want to use email or portals and tech providers have to accept that what clients want takes precedence. Organisations who have not invested in user-friendly mobile apps and mobile first solutions are significantly behind the times and run the risk of not attracting Millennial and Gen Z consumers or losing them to more digital first services.

In essence, the industry must ask itself: Are we looking through the right end of the telescope? Are we truly anticipating the needs of tomorrow’s clients, or are we merely reacting to today’s challenges? To thrive in the years ahead, firms must embrace a forward-looking mindset, monitor data – user behaviour and engagement while continually innovating and adapting to meet the evolving expectations of clients across all generations.

In this era of unprecedented change, the firms that dare to look beyond the horizon and embrace the future of client engagement will emerge as the leaders of tomorrow.

Written by:

Using data to keep on winning

As I write, already in May, the protection season is in full flow. What begins as a slow start in January, a grid of providers and distributors creeping forward, soon springs into gear. Everyone racing at full speed. There will, inevitably be the odd safety car along the way, as we go through typical downtime such as Easter, but hopefully 2024 won’t see more full race suspensions like COVID.

So, looking at the data for the race this year so far, it’s clear that track conditions are good. Given a number of headwinds the market continues to push through including the tail (it could be a long one) of the cost-of-living- crisis, a depressed housing market and the continued uncertainty created by Consumer Duty and its ongoing impact on protection advice. The picture looks good so far.

Both quote and application volumes processed through our leading portals are ahead of their ’23 split times and it is clear there is one current clear leader.

We were delighted to report that Income Protection is in prime form and is quicker than ever. April saw our record week for IP quotes / applications, and there is no sign of it stepping off the gas any time soon.

But, as with any race, there are far more stories developing behind the lead, as driver and manufacturer battles continue to rage. Our data has also seen quite a large shift in the provider placings, as the impact of performance, tactics and race set-up continues to evolve. We think there could be some interesting placings when the season comes to close.

That’s why in-race management is so important. Races and seasons are won and lost by those who understand the emerging trends as they take place, not after they happen. It could be tempting to think that within the protection market providers have weeks or days to analyse, to go into the ‘pits’ and make decisions, but the provider race moves faster than that. Pricing updates and product pivots are made by some in hours, not days or weeks. In the world’s most competitive protection market, every second counts.

What’s more, race conditions are changing continuously too. We’ve just seen the announcement that two leading manufacturers are to join forces and become the market’s latest supercar, as if both weren’t super enough anyway. These changing dynamics also impact the competitive landscape and staying competitive is the key to winning the race.

Reflecting on my previous article in the December edition, I talked about forward thinking providers. Providers who are at different levels of data maturity yet recognise it is a necessary investment and requires close analysis to make those all-important data driven decisions in order to succeed.

This is all proof that data is fundamental to driving our industry forward. I’m thoroughly enjoying my new role working alongside those providers who can see just how vital data is for their journey, and I can’t wait to see who closes out the 2024 season as champion.

Written by:

The pensions revolution. Build on solid foundations

Most will know iPipeline from our place in the life and protection market. Our tech powers five leading providers and 50% of all advised quotes processed in the UK. As such, many will be familiar with the concept of the protection gap, the notional financial gap, or the extent to which the UK public is underinsured against the impact of ill-health or early death.

I’ve no idea what the last quoted gap was estimated to be, suffice to say it’s still a very big number, and continues to grow. It is less a gap and more a canyon.

As I write, there is again much, much talk of gaps within the FS market, with pensions once again come under the spotlight. Pensions differ to protection in many ways, first – most people actually like the idea of drawing their pension. It’s a benefit they can actually get rather than their beneficiaries.

Pensions are a widely accepted and understood component of financial planning. Even if the majority of people don’t save enough, most do understand the need to save. Protection – not so much. It can be an uphill battle to get consumers to engage let alone protect.

However, there are similarities. First, the pensions market now has a gap of its own – this time identifying the difference in typical pensions savings of men and women, highlighting a key gender divide.

Equally, there are similarities in the technology landscape of both markets. Both have been rightly accused of lacking the investment and dedication to technology required to meet changing adviser and customer expectations. Digital first these markets are not.

Or perhaps, you could argue, this was the case until investment in recent years by protection providers accelerating a movement to the digital age – they have, if you like, created a technology gap between the sectors.

Meanwhile, the pensions sector has continued to suffer the fallout. A continual stream of poor service stories has painted the picture of a market struggling to meet the demands of now, let alone planning for the monumental changes required in the future.

And these changes will keep on coming. Yes, the pensions dashboard has been delayed but the deadline is now fast approaching. The demand for smoother, more efficient pension transfers isn’t going away. The noise is indeed getting louder. Even talking to my brothers on a rare weekend get together, the subject came up and particularly focussed on the difficult and administratively demanding process of how to track down pension pots. Especially when you’ve had a fairly large career portfolio of jobs, moved house a couple of times and lost track of smaller pots.

The issue for providers is how to plan effectively for the future when meeting demand today is already a challenge. This isn’t through a lack of desire, but often a legacy issue – providers who are constrained by aging technology which is creaking under pressure.

So, when consultancies or technologists talk about the huge opportunities (and hurdles to overcome) around topics like AI, it is tempting to neglect the basics. Big picture thinking is likely to be transformational in the long run, but will it solve the problems of the here and now?

Within the pensions market, those problems are often the result of a legacy. The legacy of legacy if you like. Systems and platforms that are not only unable to connect or join the dots and speak in the language of modern technology but are unable to do the basics of today. They lack reliability, flexibility, connectivity and manageability – often driving up cost and risk for providers in managing their technology estate.

So, I read with interest the commentators talking of a new dawn in financial services technology, of connected systems, connected data, of user experience fit for 2024 (not 1984). Then I take a step back and ask, are the foundations in place to build the tech skyscrapers of tomorrow?

Foundations which include simple, efficient and reliable back-office systems. Systems which not only allow staff to work quickly and efficiently but empower advisers and customers to manage their own policies online. Systems which perform the simple yet numerous transactions with ease and reliability. Systems which provide the building blocks for providers to deliver a personalised, cutting-edge user experience.

For many the answer is still a firm no. Which leaves many at a standstill. Not able to take part in exciting (and challenging) debates about what the future holds. Not able to take advantage of the coming tech revolution. Not able to deliver what their customers increasingly demand.

The solution is simple. Invest in the right foundations. Build the basis for future excellence. The time is now.

Written by:

Beyond insurance, behind the numbers

Aviva’s Individual Protection 2024 Claims & Wellbeing Insight

Paying claims is at the heart of what we do every day. Last year we paid out £1.18billion and settled 50,631 claims. In our Individual Protection 2024 Claims and Wellbeing Insight report you’ll see our consistent track record in paying out claims and the facts and figures behind those claims. This year we’ll take you beyond insurance, behind the numbers, sharing the insights, case studies and service our customers experience when they need us most.

Focused Feedback

We’re paying close attention to what your feedback is telling us on servicing and ease of working together. The ‘Send to customer’ (Delegate) functionality with ALPS new business advised journeys now allows you to send the health and lifestyle questions directly to your customers to complete online. Last year, we also partnered with fintech provider ORIGO to offer a digital Letter of Authority (LOA) process. Your LOA protection product requests and responses can now be obtained electronically through the ORIGO service. It provides a secure, efficient process, reducing rejected requests and simplifying interactions.

Macro Environment

We keep a close watch on the economy and adjust accordingly. We recognise that the cost of living is very difficult for people and there is no obvious point when things will improve. In 2023, we introduced the Cost of Living Support scheme which operates alongside the payment deferral scheme that was put in place during COVID-19 for any customers experiencing short-term financial difficulty. Helping your customers keep some valuable cover in place over the next few years by reducing the sum assured on their policy to make their premiums more manageable. This increased flexibility addresses customers’ future needs, as well as highlighting the importance of advice in the process. By making these changes, we aim to help you work with your customers to keep some cover in place rather than cancelling their policy outright.

Rise of Mental Health

Throughout 2023 we’ve seen an increase in the need for mental health support as customers struggle with financial and economic uncertainty. Mental health doesn’t discriminate, anyone can feel stress, depression or anxiety symptoms. Having the right support at the right time can make a huge difference in how long poor mental health continues. It’s our mission to support when and where we can, not just at the point of claim. With an Aviva individual protection policy your customer may be able to access the Aviva DigiCare+ app provided by Square Health for support with mental health. Aviva DigiCare+ is a non- contractual benefit Aviva can change or withdraw at any time.

World of Support

We look beyond protection cover and strive to support customers from day one of their cover with us by offering access to a range of health and wellbeing services and tools. Aviva DigiCare+ is helping to prevent, detect, and manage common health and wellbeing problems. Last year we saw 147,971 new customers register for DigiCare+ app and DigiCare+ Workplace app (available through Group Protection) and start to benefit from the valuable benefits provided through it. We’ve also sent hundreds of thoughtful gifts to children and their families going through critical illnesses, hoping to brighten their days.

The work we’ve done across the year was recognised by Money Marketing who awarded us Best Protection Provider 2023. More than this, we’ve helped our customers beyond insurance, we’ve helped when they needed us most.

Written by:

Quarterly Q&A with Paradigm

This edition, we’re in conversation with Mike Allison, Director of Protection at Paradigm who talks optimistically about the opportunities in the world of protection, particularly in light of the Consumer Duty rules. Mike has been Director of Protection since the launch of Paradigm Protect 10 years ago. He champions both the work of the providers and advisers at every opportunity, with a focus on quality and delivering the best possible customer outcomes. His deep knowledge and insights on all things protection are a valuable asset to our industry.

Mike, what are your views on the current market?

“In talking to many of our firms at Paradigm, there is more of a sense of optimism about the mortgage market emerging and more opportunities appear to exist, which of course drives a lot of activity within the protection space. Lenders are offering some competitive rates, and depending on their circumstances, there will be some customers who may be better off than had been predicted when it comes to remortgaging. It is really positive to see that the housing market is on track for 1.1 million completions in 2024, a 10% increase on last year, and mortgage approvals are reaching pre-pandemic levels as consumer confidence is starting to rebound.

In reality, many advisers have a choice to work with many of their clients on Product Transfers (PTs) but choose not to do so – we still see that the majority of PTs are written directly with the lenders and not through the intermediary space. This contracts to new business, which sees a c.80% split written by intermediaries. We know that there may be commercial reasons for advisers not working on PT business – or at least being selective when they do – but it is important that they see the importance of building long-term relationships with clients. These should cover all product areas including Protection and GI – the latter in particular can provide a regular income stream over may years.

At Paradigm, we have been working hard to help firms develop soft skills, grow their business and identify new potential revenue streams.

In terms of negatives, we are in the early phase of the Regulator assessing firms’ Consumer Duty plans, which were supposed to be in place from July 2023. It remains to be seen how the FCA will react to firms if their plan implementation is below expectations, and that uncertainty can lead to concern – particularly in smaller firms regarding the work they may need to do to get up to scratch. I’d encourage any firms who are unsure to speak with trusted compliance firms to check they at least have robust plans and can evidence what they’ve been working on.”

What are the biggest/main challenges we will face this year?

“I believe the main challenge is the uncertainty over interest rates and when they will start to fall. It appears at present that inflation is under control and on target to meet the Government’s plans, and so the impact of the cost-of- living crisis over the last 18 months or so is waning on potential and existing customers. Interest rates, however, are a different animal altogether, with the decisions on these often being driven by worldwide events.

In the mortgage space, whilst Lenders are changing rates and creating ‘windows of opportunity’ for customers, they are generally doing so based on their own profit models – as opposed to SWAP rates – which are more difficult to predict. This inevitably leads to additional work for mortgage advisers trying to ensure their clients access the best rates and often leads to amending suitability letters, all of which is time consuming, and in some instances can take the focus away from protection. When interest rates do start to fall, we can expect to see further surges in activity for both mortgages and subsequently also protection. We know that when customers feel they are saving money on their mortgage, this can drive increased sales of protection products.”

What are our key opportunities for 2024?

“Opportunities arise in a number of areas in the world of protection. For example, we have seen the surge in Income Protection sales as a result of a number of factors. This has come from, in my opinion, consumers being more aware of and wanting this type of protection (as evidenced by numbers of Google searches) and fears arising from the cost-of-living crisis coupled with the difficulty in obtaining mortgages, for first time buyers especially. More than ever before, people want to protect the roof over their heads. This, coupled with the work of advisers, Providers, the Protection Distributors Group (PDG) and the Income Protection Task Force (IPTF) in highlighting the need for this insurance has led the demand and supply side to work as it should to achieve greater sales.

With this brings greater product innovation in a number of guises. In particular, we see many of the Friendly Societies continue to offer products to consumers in a wide range of occupations, and with a real flexibility to smokers, vapers and those with ailments that historically have been difficult to cover. All of this delivers real tangible evidence that they are improving access to insurance.

Consumer Duty has led to many firms reviewing their business propositions, and one area we have been working with Paradigm firms on is the development of specialist Protection advisers within both mortgage and IFA firms. In IFA firms in particular there is a huge opportunity in the intergenerational planning space – especially where so many surveys show that the estate beneficiaries (usually any children), are unlikely to use the same adviser as their parents when the wealth transfers to them, unless they already have a relationship with the adviser firm. Wealth firms who ignore intergenerational opportunities, for example the opportunity to at least discuss IHT with children or beneficiaries of an estate, are not only missing a commercial opportunity but are in danger of seeing their Assets Under Management decline.

Inevitably, technology marches on in all of our lives, and although there has been much talk about the impact of artificial intelligence (AI), we have not yet seen many direct results of AI on our market, but it is coming. In addition, there has also been talk about further innovation in the compliance area that will ultimately support advisers; streamlining processes and saving valuable time. As new products come to market, or products such as Income Protection see an increase in popularity, advisers should take any opportunities to discuss these with existing clients. Tools such as PreQuo from iPipeline are a cost-efficient method of generating leads from a firm’s existing client base.

We should not forget that opportunities exist when it comes to signposting to external firms too; firms who may not wish to write protection business themselves should have a solution for referring clients to ‘avoid foreseeable harm’ within their Consumer Duty plan. We know that we should be discussing the risks of not taking out any form of cover with all clients, but in reality sometimes we are just too busy, and to have a signpost partner for at least some of the client base will do the job the Regulator wants.”

“It seems clear to me that there are opportunities abound within our market, and those firms who are up to the challenge will be able to harness these in 2024 to grow and develop their business, with clear benefits for their customers too”

Written by:

The rise of GenAI

AI is not new, but the availability of high- performing compute resource and internet- scale data sets, coupled with technological advancements in the way machines learn, have created the perfect environment for AI to thrive.

Among the many recent innovations, Generative AI has captured our imagination for its ability to communicate with us in almost human-like fashion. A subset of machine learning, characterised by its ability to process complex inputs and respond with original content, the possibilities for this exciting new technology are hard to overstate. Generative AI has the potential to transform the way we work and the experiences we offer to our customers, but extracting these benefits whilst ensuring quality and safety needs careful thought.

The Large Language Models (LLM’s) that power Generative AI are the Swiss army knives of the AI world. Trained on massive data sets, they possess impressive knowledge and an ability to answer questions on a wide range of topics. However, for many applications it is their intrinsic ability to understand language, and their ability to understand and work with data, that is of higher importance. We can talk to them, and they understand. They can reason over the data we provide, extracting relevant information and using it to answer questions, solve problems, create documents, images, presentations and more.

These generalized abilities however present a challenge – how can we narrow their focus to a specific industry, a specific product or a specific document? How can we keep their responses grounded in our content rather than the terabytes of data they absorbed as part of their training?

Continued pre-training and fine-tuning enable models to develop specialisms, but typically require large volumes of training data and specialist knowledge to get good results. Retrieval Augmented Generation (RAG) takes a different approach by providing relevant extracts from source material as additional background context to the question. Prompt Engineering – crafting questions (or “prompts”) in such a way to elicit the best possible response, including verbosity and tone of voice – has arisen as specialty subject with whole books devoted to it. But alongside this has also risen the risk of Prompt Injection – deliberately manipulating prompts to try and guide a model to reveal sensitive information or respond in a manner that could cause brand embarrassment.

But despite the risks, the promise of AI is too great to ignore. Easy access to off- the-shelf models and an ever-growing library of AI enabled tools and services is enabling and driving rapid innovation.

And with technological guardrails in place, strong governance and oversight, and with humans in the loop at key points in the process, it is possible for us to begin leveraging the power of AI now, whilst continuing to protect our data, our users and our reputations from harm.