Term & Health Watch 2023

On 21 May, Swiss Re published Term & Health Watch 2024. This is an annual analysis of new individual protection sales in the UK from the previous year, based on sales data provided by protection insurers. iPipeline has been a key contributor to the data for several years, adding insights gained from its platforms.

I appreciate it may seem odd to be writing about 2023 when we are already almost halfway through 2024. However, the publication of Term & Health Watch each year is a helpful time to pause and reflect on the trends we saw last year and what is continuing into 2024 or beginning to emerge.

Looking back, 2023 was another challenging year for total sales in the protection market. However, this was not felt equally across the product lines. We saw a total market decrease of 5.5% but this was led by a drop in term assurance and critical illness sales, which fell by 10.4% and 3.2% respectively. This was largely due to a slowing housing market and a sharp decline in non-advised sales (we saw a 27.7% drop in non-advised level term assurance sales).

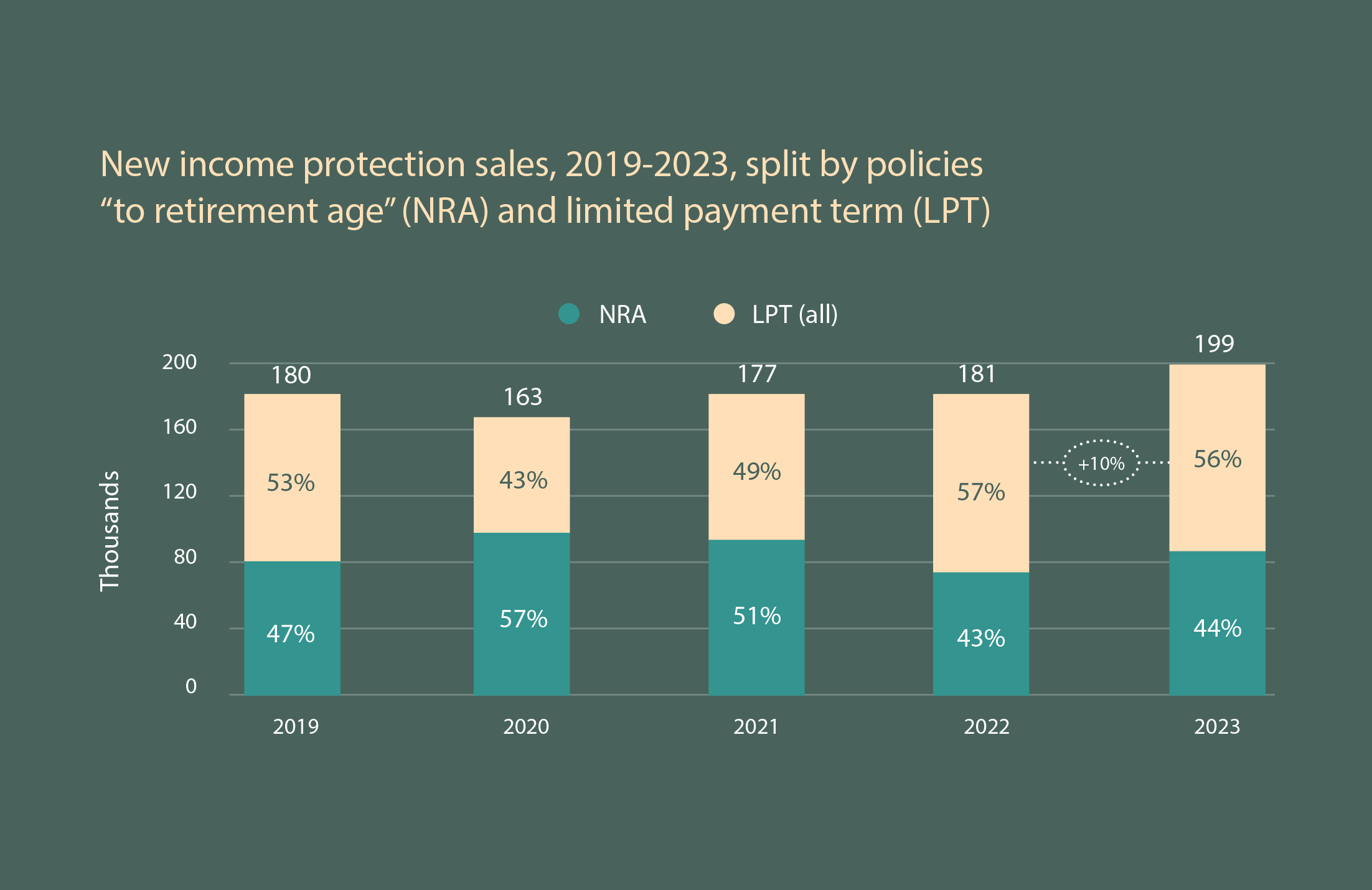

It is not all doom and gloom though. We saw a rise in income protection sales (by 10%), guaranteed acceptance whole life (by 7.7%) and underwritten whole life (by 4.2%).

It is great to see that income protection sales continue to grow at a good pace. We were pleased to see that this growth was driven by an increase in sales in both the “to retirement age” and the two-year limited payment term products, where in previous years the growth has been led by the latter.

Limited payment term products represented 56% of all new sales, a small shift from 57% in 2022. The two-year product is the most popular, representing 96,817 of total sales, an increase of 12.2% from 2022. This has fluctuated over the last few years as you’ll see in the chart below.

It is positive to see that customers are buying income protection products, regardless of payment term, as this will provide some form of safety net if the worst were to happen. This is especially the case for those who receive no workplace cover above of Statutory Sick Pay (SSP) or are self-employed and would have no access to SSP.

While we are not out of hot water fully yet as we still experience elevated interest rates and an upcoming General Election which can bring a degree of uncertainty with it. The industry should keep up the momentum for income protection and focus on the green shoots taking root in the market.