Summer 2024 Introduction

In May, Swiss Re launched Term & Health Watch 2024, a report iPipeline have supported with our data for the last 5 years.

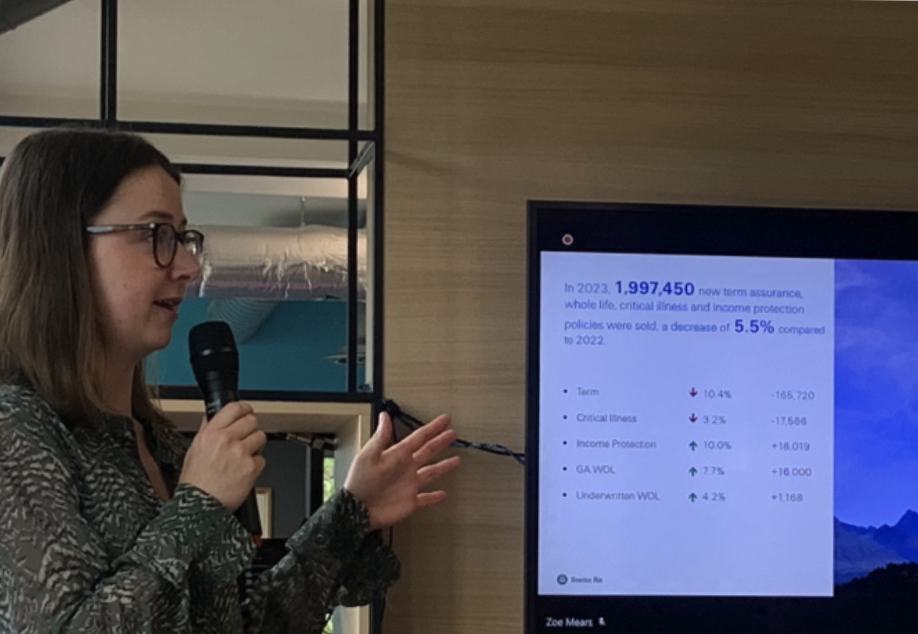

We were delighted to welcome Joanna Scott, Technical and Industry Affairs Manager at Swiss Re and one of the lead authors of the Term & Health Watch, to our office recently to hear a high-level summary of the report. The stats were fascinating, some unsurprising, some rather more alarming.

Term & Health Watch looks at individual protection market statistics including term, CI, IP and WOL. It is a combination of data from providers across the market at the end of the year, plus iPipeline insights throughout the year which provide more granularity.

So, what did we learn? Total new term sales have declined by 10.4% in 2023 with the cost-of-living crisis – the lowest reported by Swiss Re since 2016, while new income protection policies have increased by 10% but I won’t steal Joanna’s thunder – you can read more on this in her article on page 4.

It’s clear that during 2023, consumers still had a tough time when it came to household spending. The Bank of England raised interest rates 14 times and still hasn’t brought it down. In the Financial Conduct Authority (FCA) Financial Lives cost of living survey issued in April, it is worrying to read that people were still not taking out insurance, or had cancelled or reduced their level of cover which explains some of the trends in the protection market.

We recently conducted a survey to understand adviser sentiment, the findings of which can be seen here. My overall takeaway over these last few weeks is that reports such as those from Swiss Re and the FCA are invaluable in understanding our market and making data accessible.

Likewise, I can also see we are reversing this downward trend in 2024.”